understanding

all of the layers

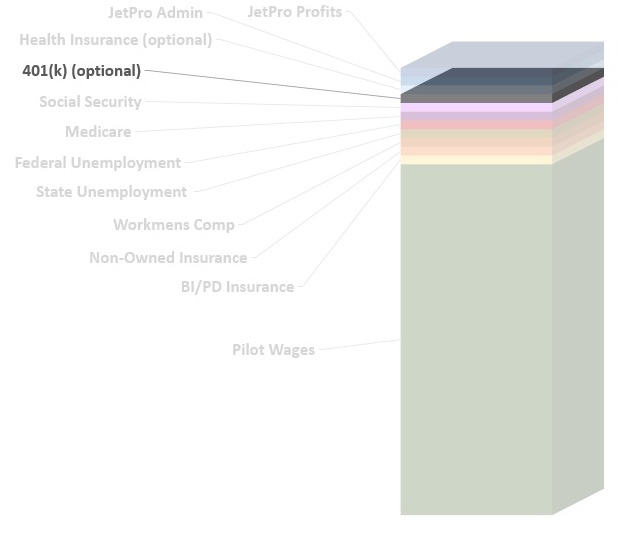

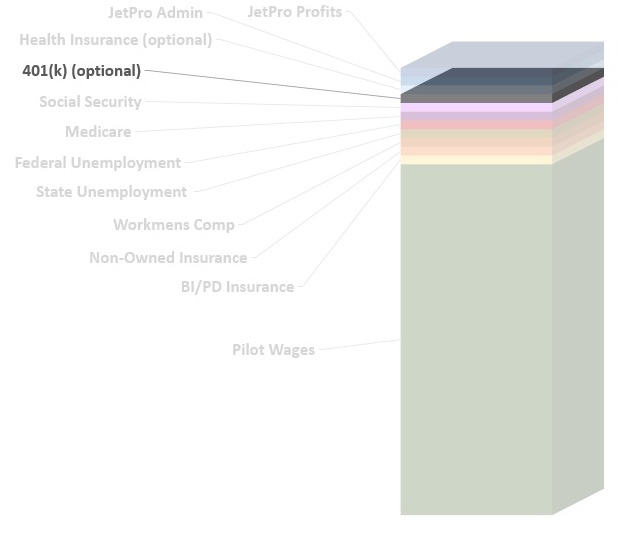

understanding

all of the layers

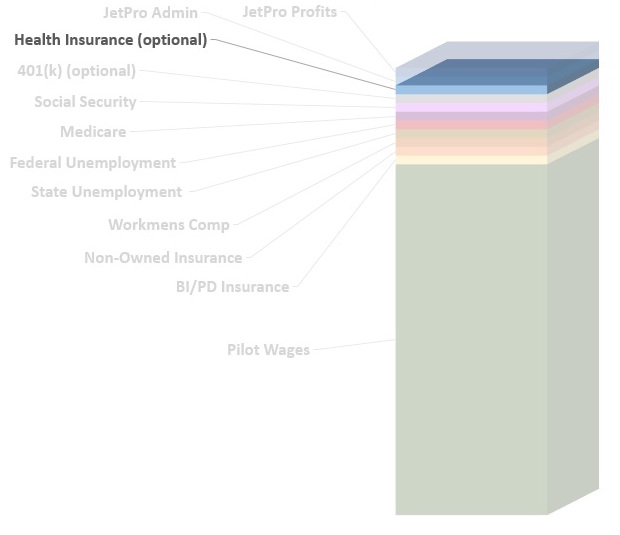

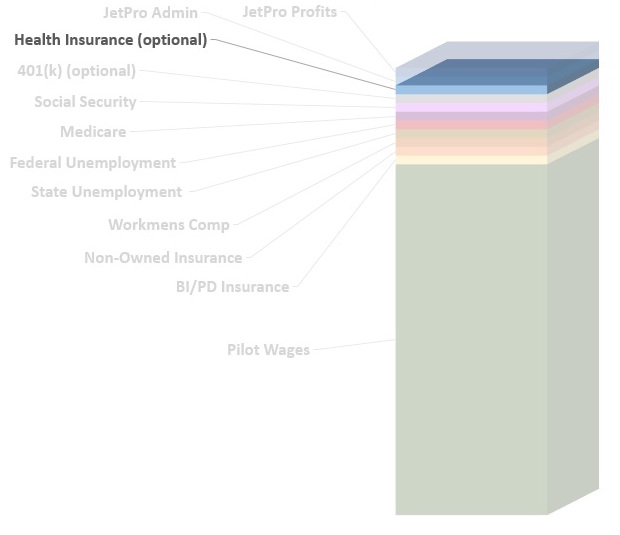

understanding

all of the layers

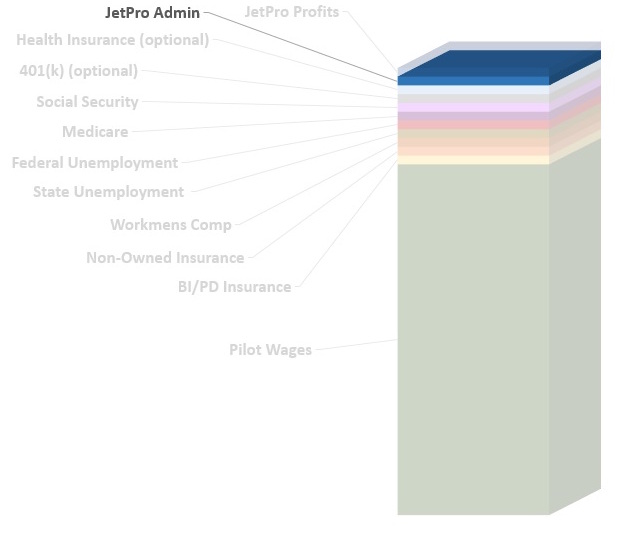

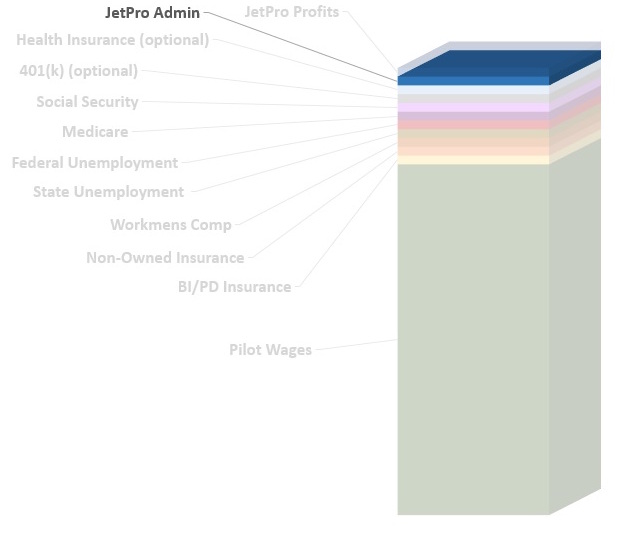

understanding

all of the layers

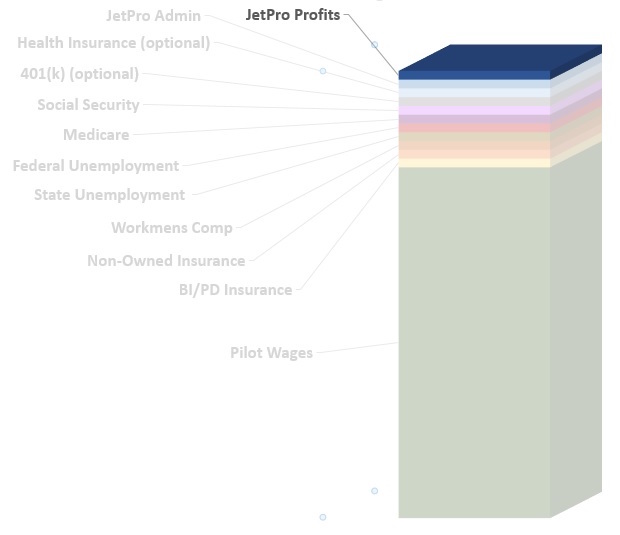

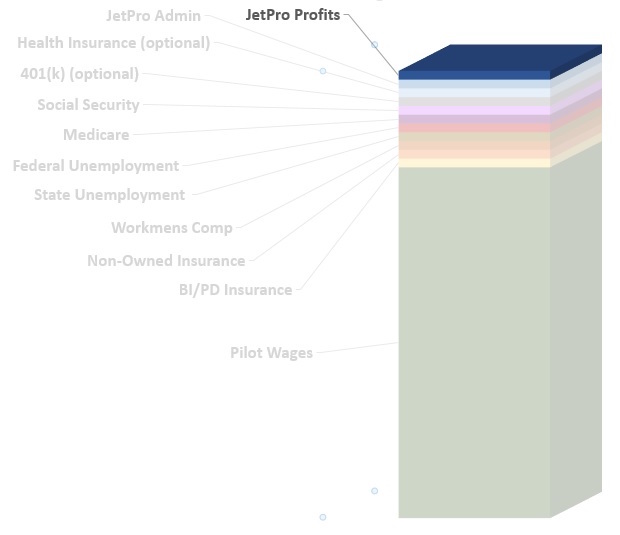

the value proposition

for partnering with jetpro

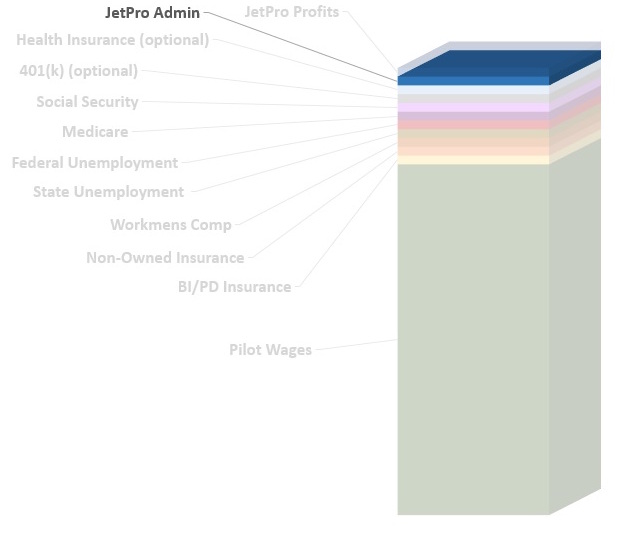

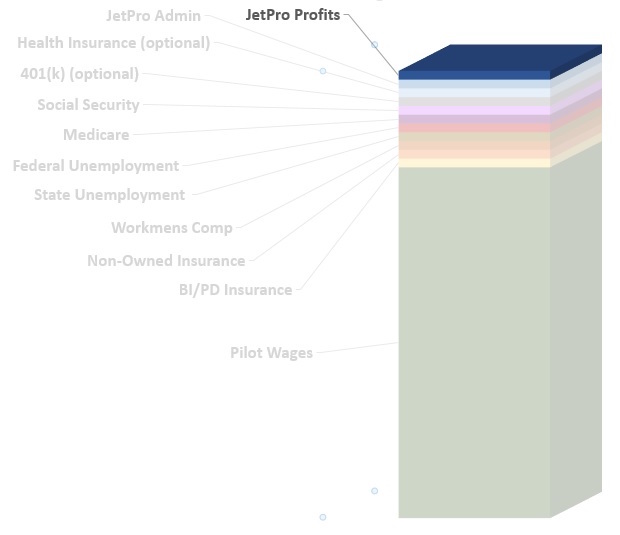

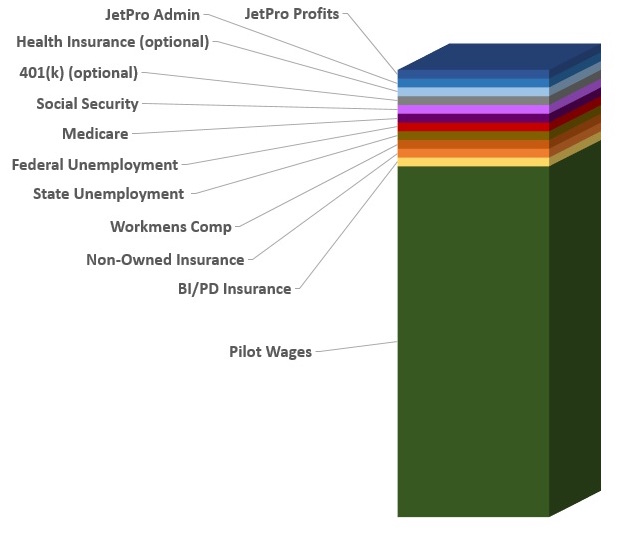

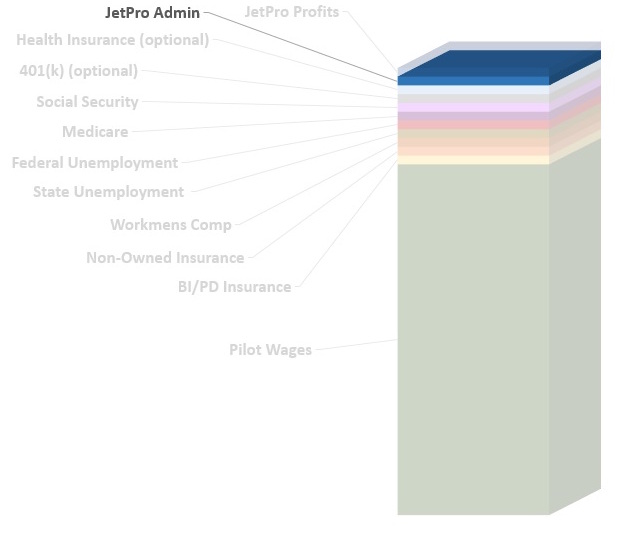

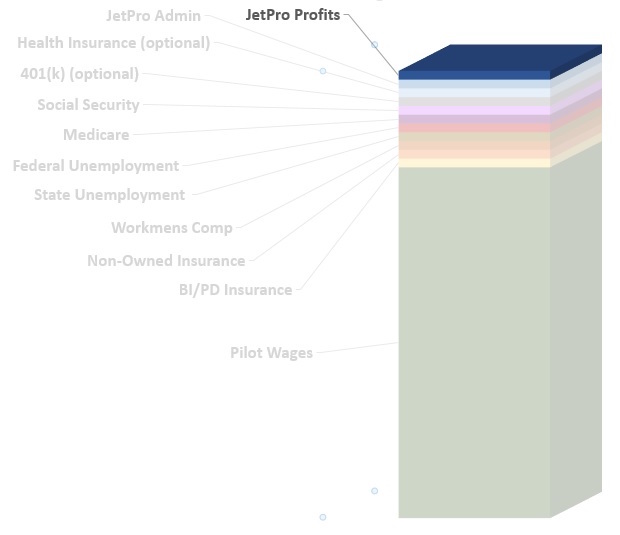

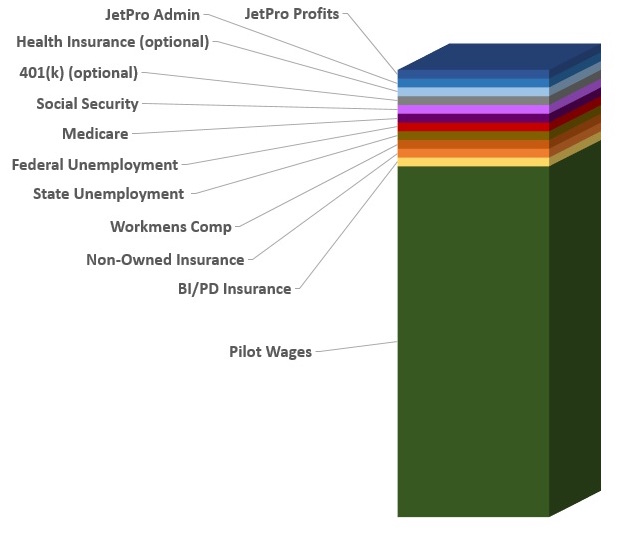

Paying a pilot for a trip as an independent contractor and sending a 1099 at the end of the year is one way to do it. However, there are several things to consider when weighing your options in how to properly staff your flight department. It is important to understand all of the pieces so that you stay legal and do not impose unnecessary risk to your flight department and your company.

- Why the Markup?

- 1. Pilot Wages

- 2. BI/PD Insurance

- 3. Non-Owned Physical Damage

- 4. Workers' Compensation

- 5. State Unemployment

- 6. Federal Unemployment

- 7. Medicare (Employer Responsibility)

- 8. Social Security (Employer Responsibility)

- 9. 401(k) (optional)

- 10. Health Insurance (optional)

- 11. JetPro Pilots Administration

- 12. JetPro Pilots Profits

- Conclusion

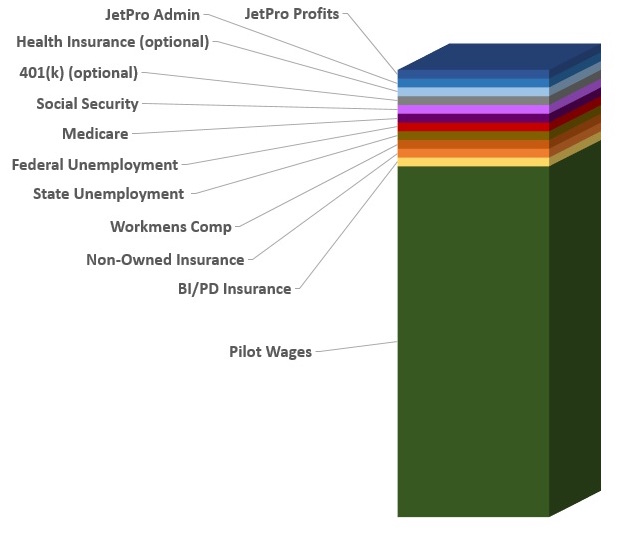

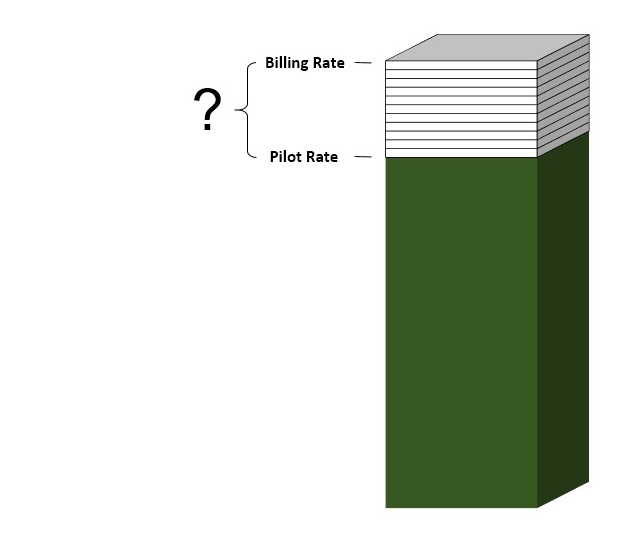

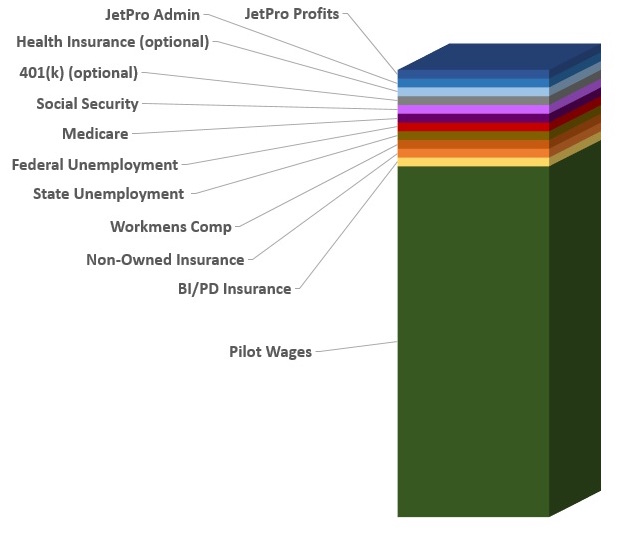

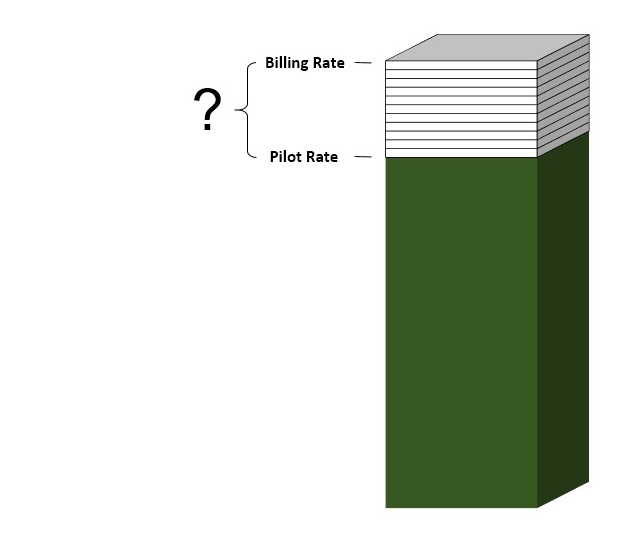

What's included in the "markup"?

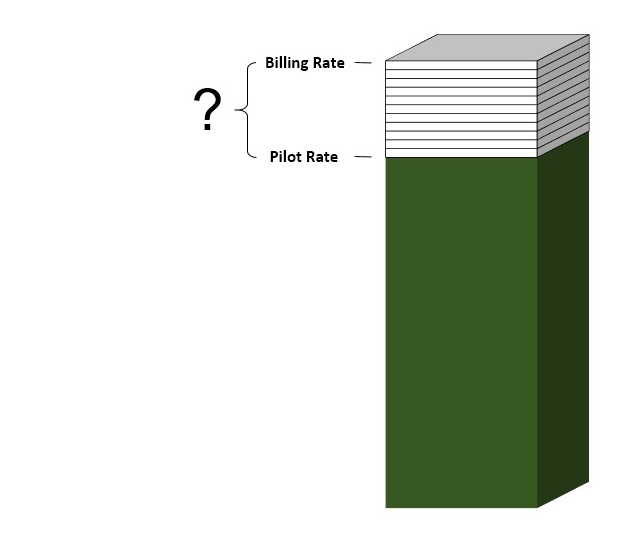

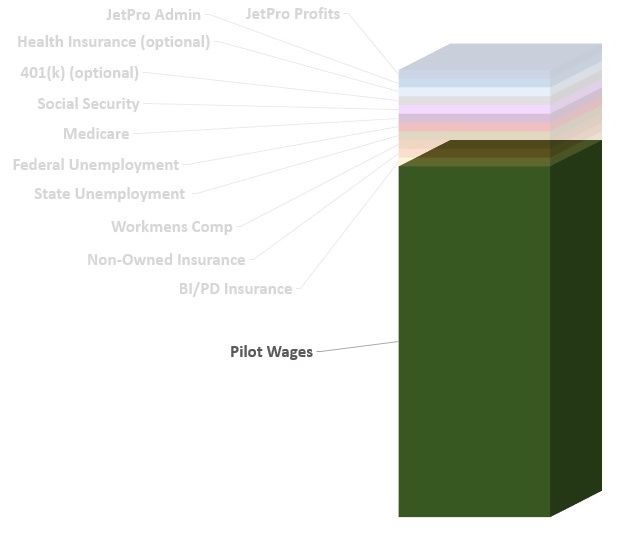

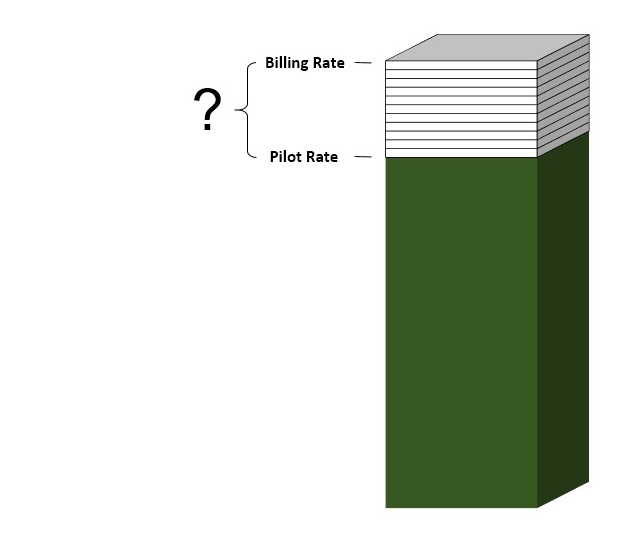

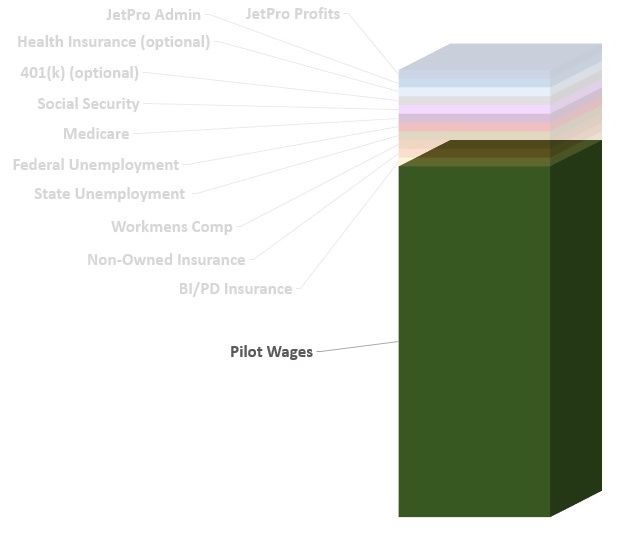

When thinking about the cost of a trip, it’s natural to multiply the pilot or flight attendant’s daily rate times the number of days then add expenses. That certainly covers the majority of the costs.

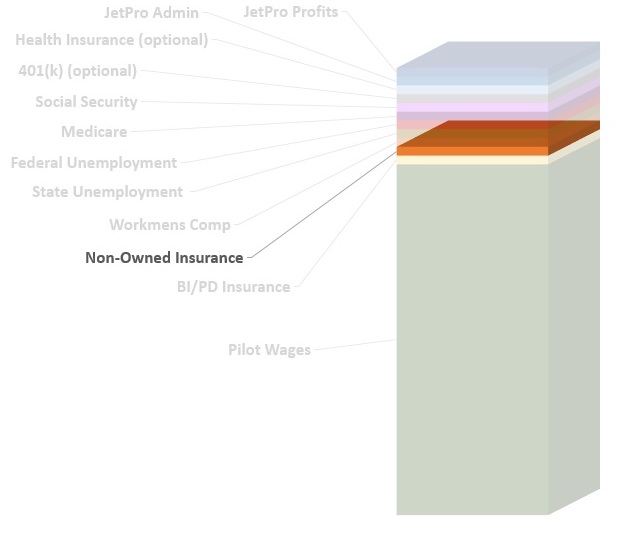

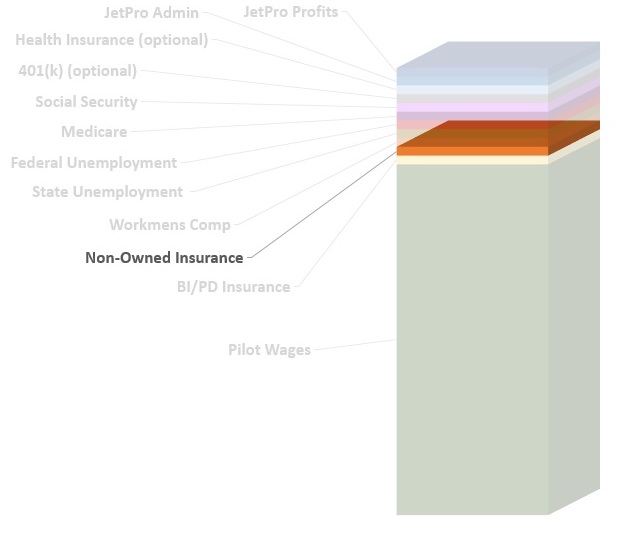

However, when trying to understand the whole picture, including staying legal and properly managing risk, we need to peel back the various layers to understand the taxes, insurance, and other personnel costs (that employers are typically required to pay) so that informed decisions can be made.

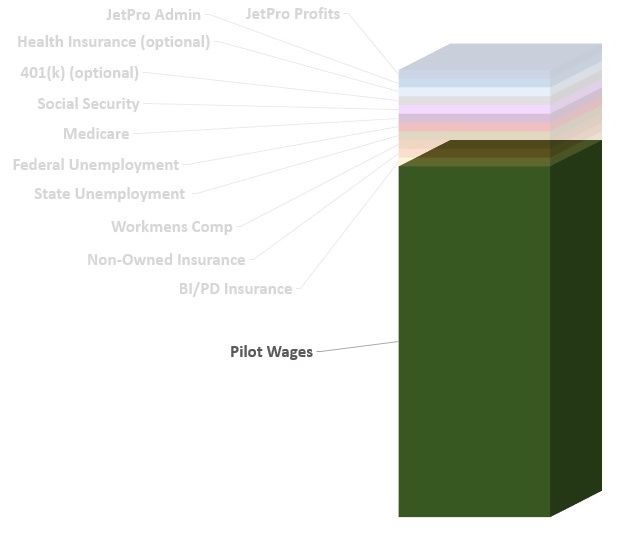

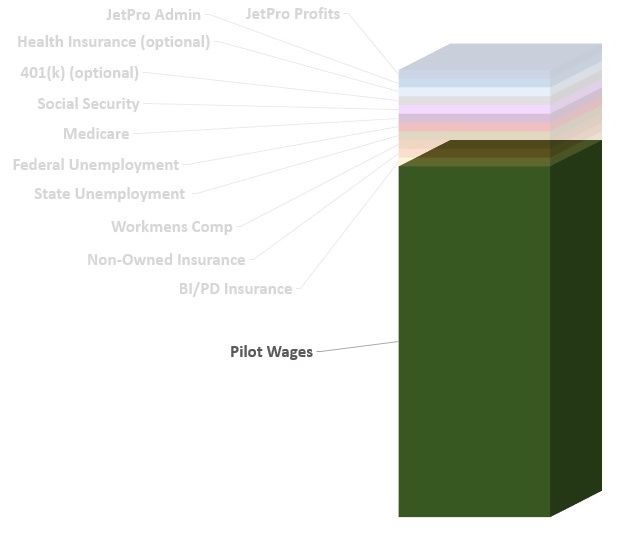

pilot wages

The pilot’s base rate is typically set as a daily rate based on the aircraft type. This rate is the pilots gross wages, and the pilot is then responsible for his or her own taxes and withholdings from this figure (the green portion of the graph). The remaining items below (which comprise the markup) are the company’s responsibilities that are typically paid in a professionally managed flight department operation.

winner: flight crew for getting a fair wage for an honest day’s work

insurance

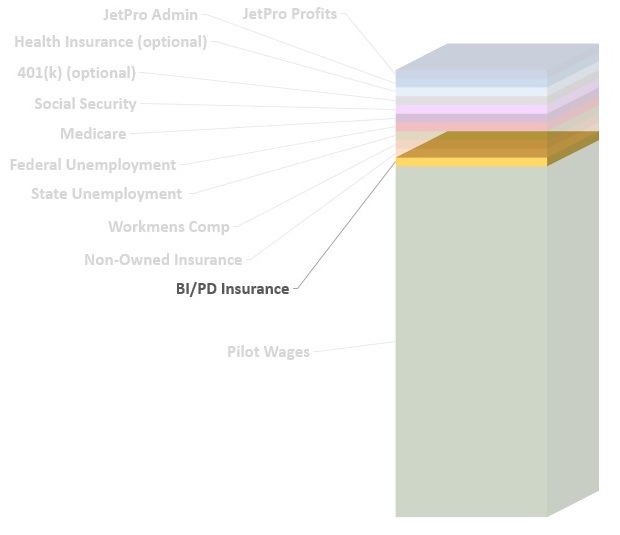

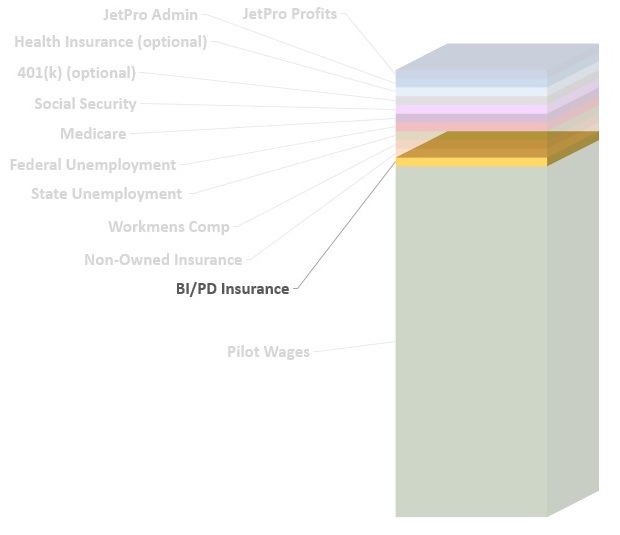

bodily injury & property damage (BI/PD)

The first two insurance items comprise the basics of the “CGL” or Commercial General Liability policy. The bodily injury & property damage covers the person (the employee) when it comes to general types of accidents. It also can cover property damage on the premises. However, a more robust insurance policy, such as the one that JetPro Pilots carries, will also include ‘Completed Operations’ coverage, which also covers accidents that happen away from the premises, since pilots and flight attendants are frequently working in locations away from their base of operation. JetPro Pilots’s CGL policy carries full BI/PD coverage.

winners: flight crews and client, as both enjoy protection and coverage that our policies offer

insurance

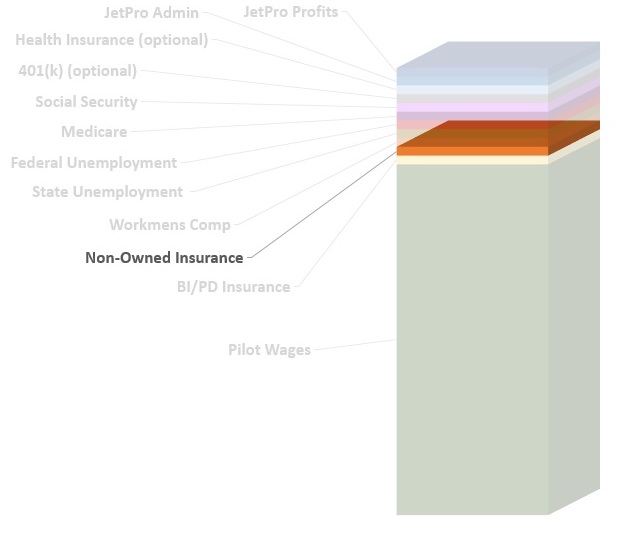

non-owned physical damage

A CGL policy (along with a properly structured contract) may cover the employee and the property owned by the company and client. However, it will not necessarily cover property owned by others unless the policy includes non-owned coverage, like JetPro Pilots’s policy does.

winners: flight crews, client, and other property owners who could be involved in a claim

insurance

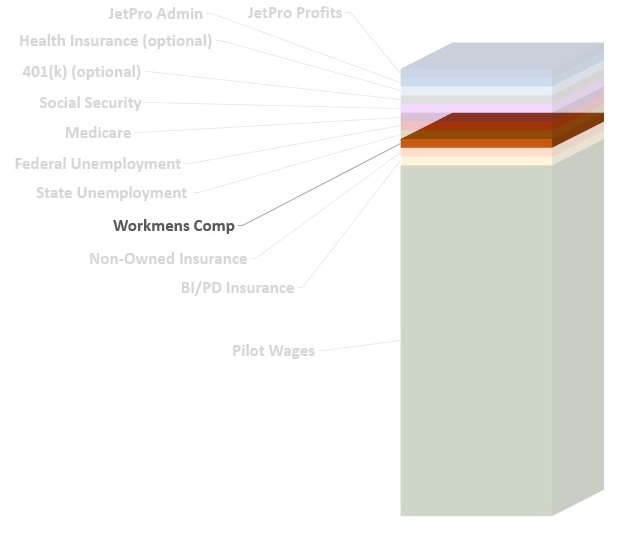

workers' compensation

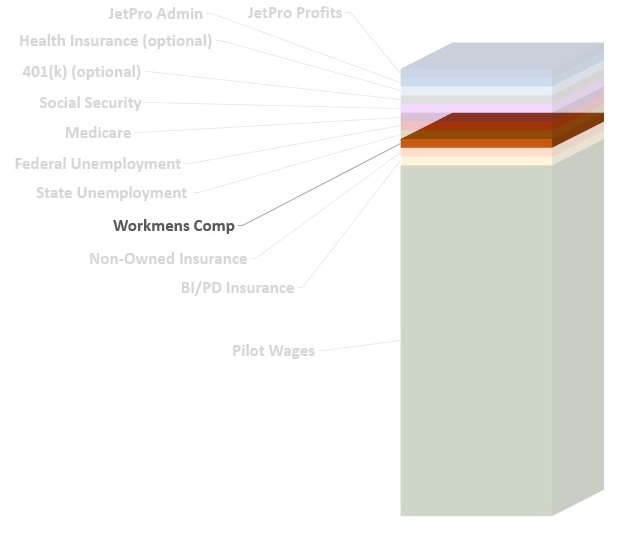

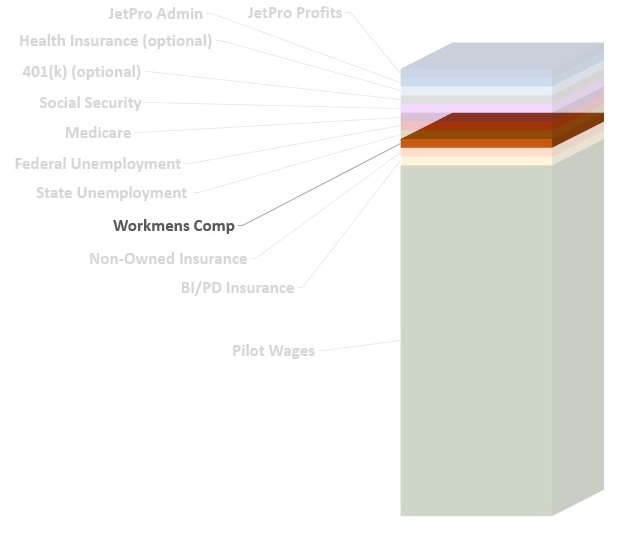

This issue touches two things: the law and proper risk management. Workers’ compensation insurance is required in many states. For those states in which workers’ compensation is required, some independent contractors who do not carry workers’ compensation may not be operating legally. It is also important to remember that even if the pilot operates independently in a state that does not require workers’ compensation insurance, this is still a risk to the flight department and the company.

An injury to an independent contractor who is not covered by workers’ compensation could cause unnecessary risk for a flight department. JetPro Pilots carries a robust workers’ compensation policy, and everyone that works for JetPro Pilots is fully covered under this policy.

winners: crew, client, and JetPro Pilots.

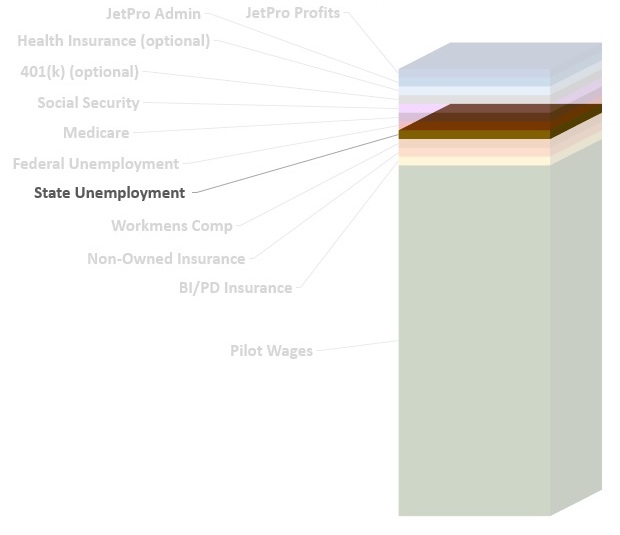

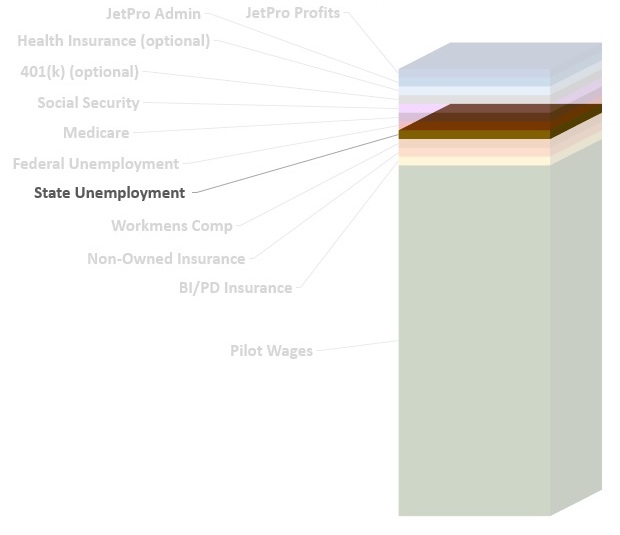

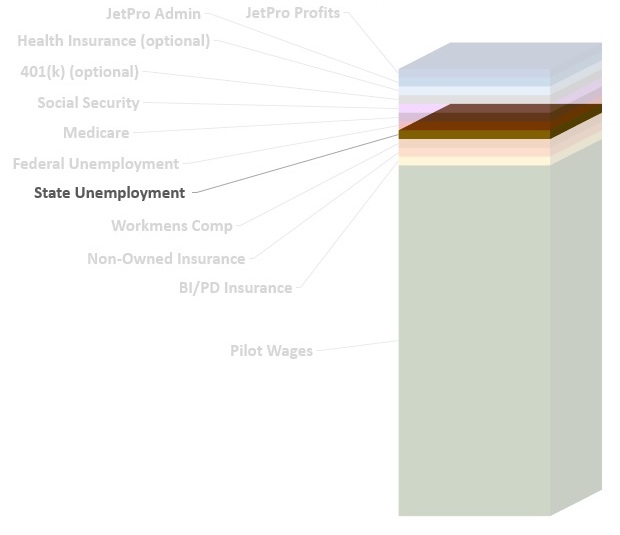

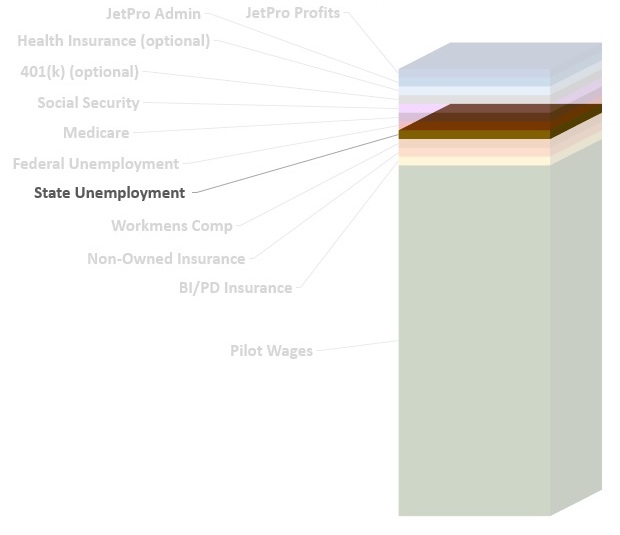

state unemployment

JetPro Pilots handles all of the payroll taxes for its employees. This includes state unemployment, also known as SUTA. While many of our crew members fly with us on a part-time basis, we have some that work full-time with JetPro Pilots and enjoy the protection that this insurance offers. The state unemployment is a tax-like insurance premium administered by the state governments that is required to be paid by the employer. JetPro Pilots administers and pays the mandatory state unemployment through its payroll process each pay period.

winner: crew

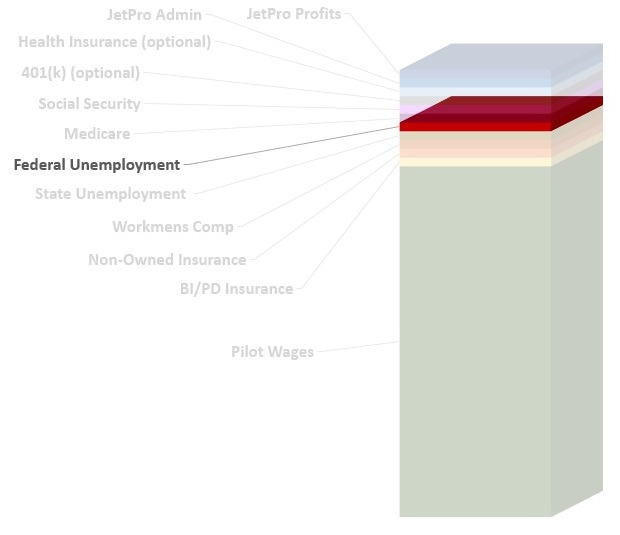

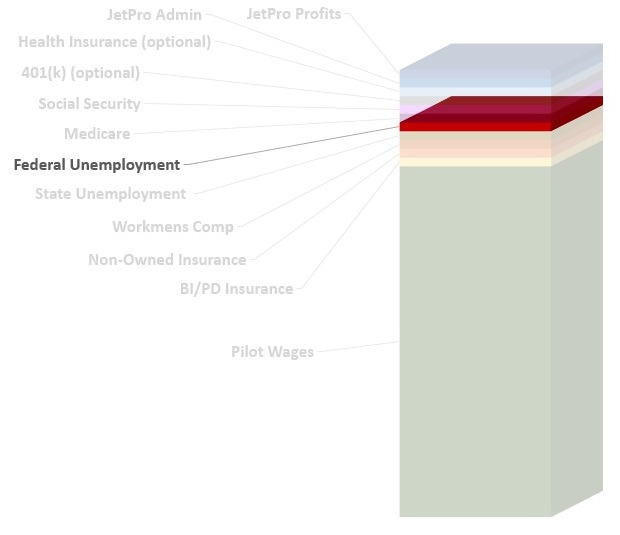

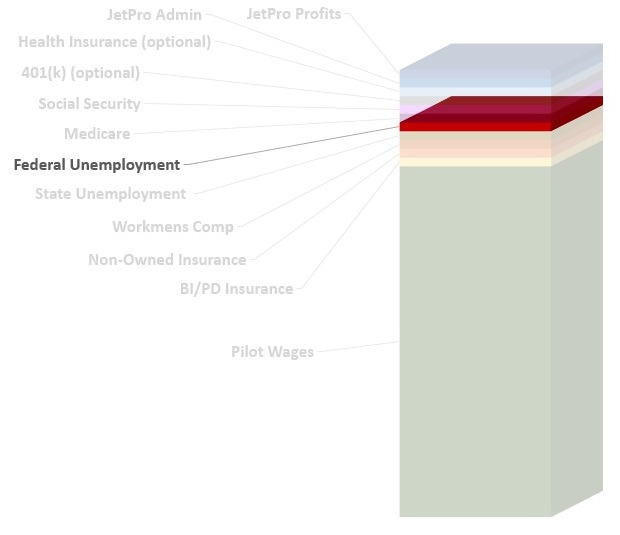

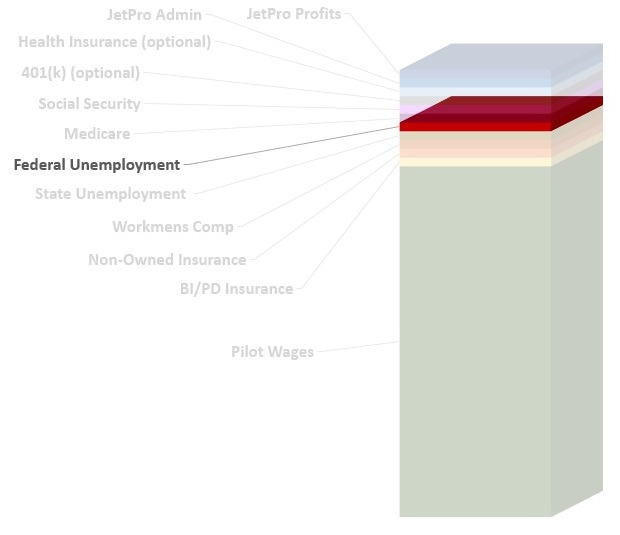

federal unemployment

Federal unemployment tax, also known as FUTA, works in conjunction with the state unemployment programs, is also mandatory for employers. JetPro Pilots also pays FUTA as part of its regular payroll process.

winner: crew

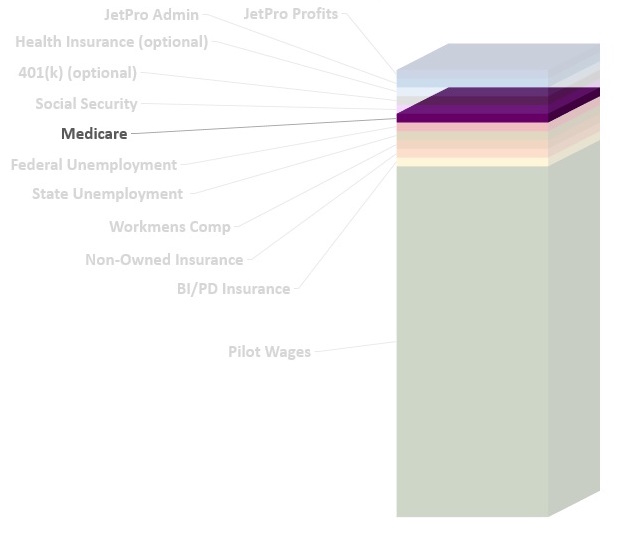

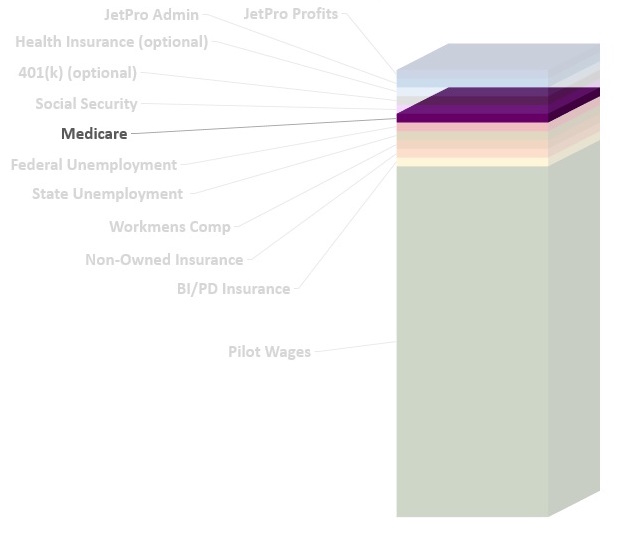

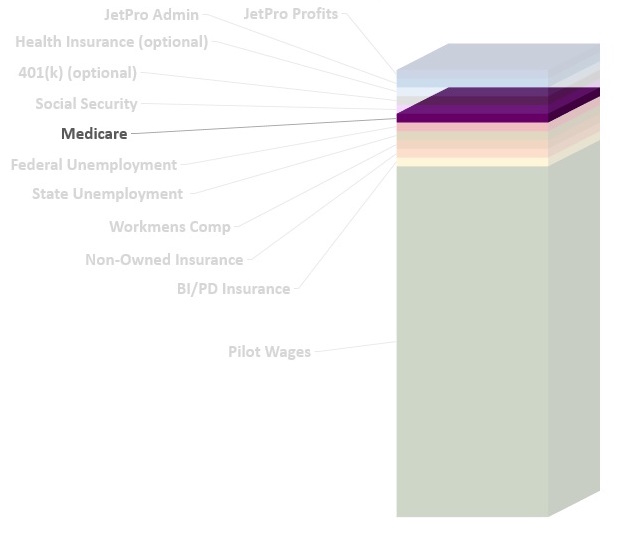

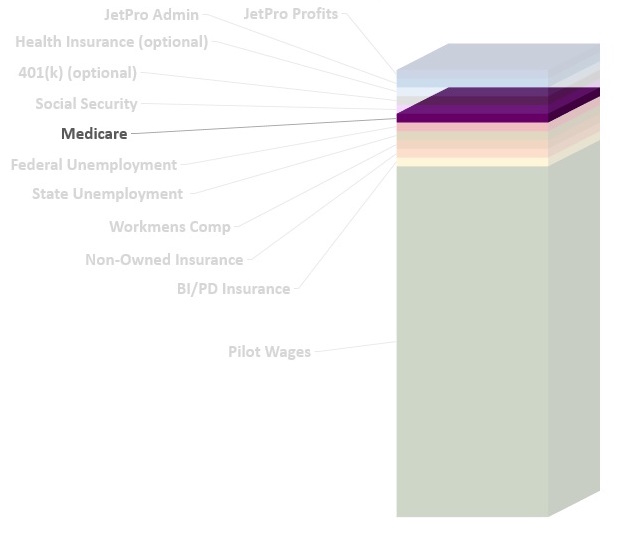

medicare

Both the employee and the employer are required to pay their share of Medicare tax. This is split evenly between the employer and employee, each paying half of the total tax. JetPro Pilots withholds the proper Medicare tax from each employee’s paycheck and administers the payments to the federal government through its payroll processing company. JetPro Pilots also pays the employer portion of the Medicare taxes.

winner: crew

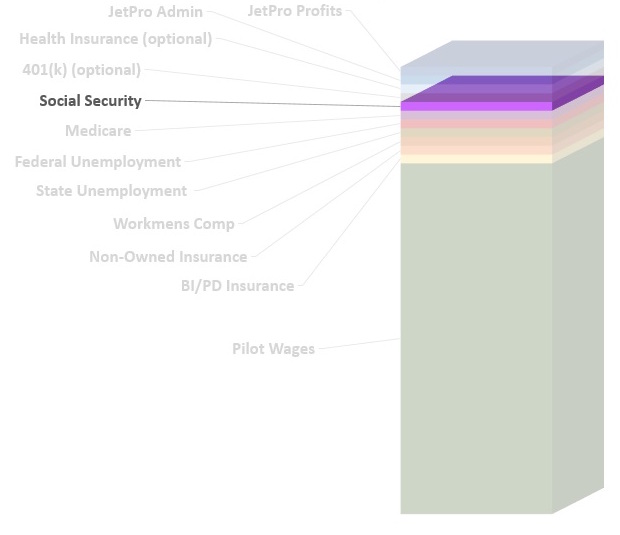

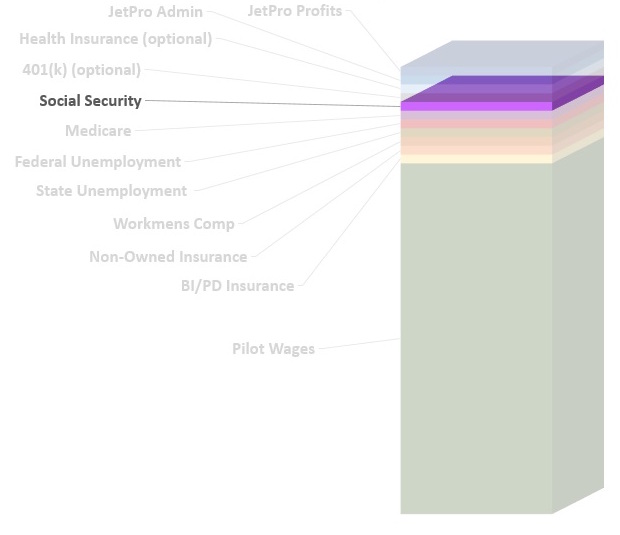

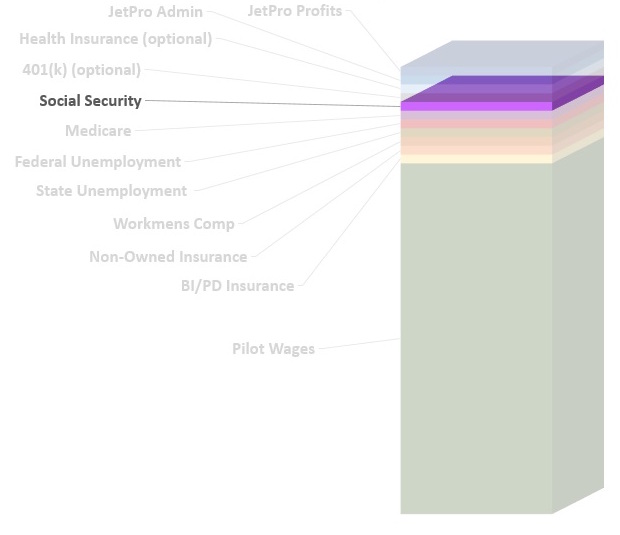

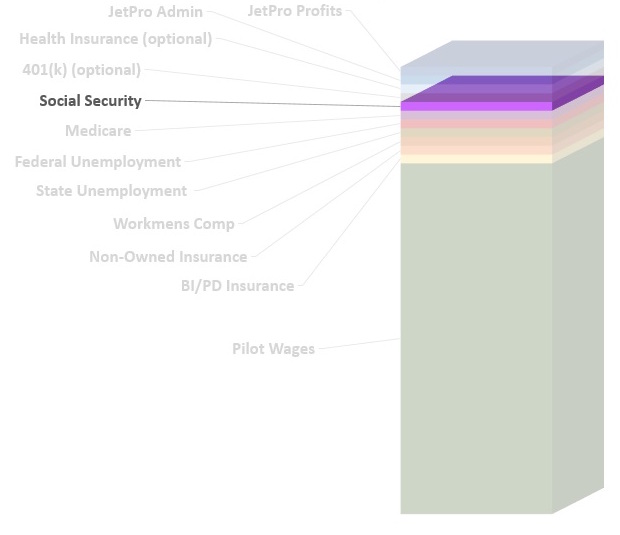

social security

The social security tax, formally known as the ‘old-age, survivors, and disability insurance tax’ (OASDI) is administered in a similar fashion as Medicare. Both the employee and employer are required to pay their share of this tax. This is also administered and paid through JetPro Pilots’s payroll process. OASDI and Medicare are sometimes combined and referred to as FICA, or the Federal Insurance Contributions Act Tax.

winner: crew

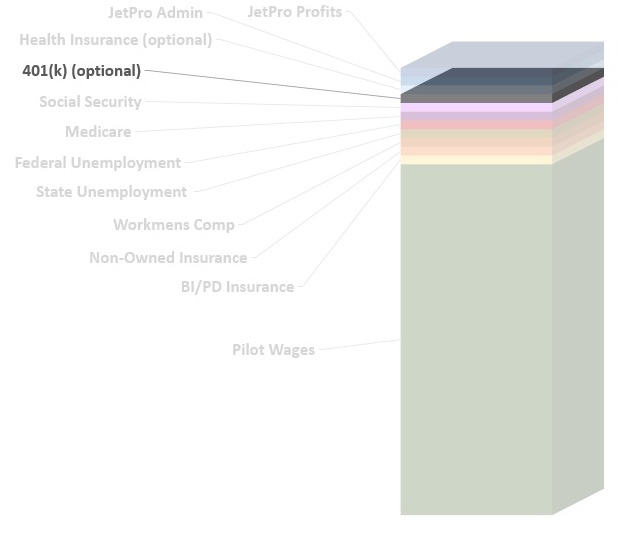

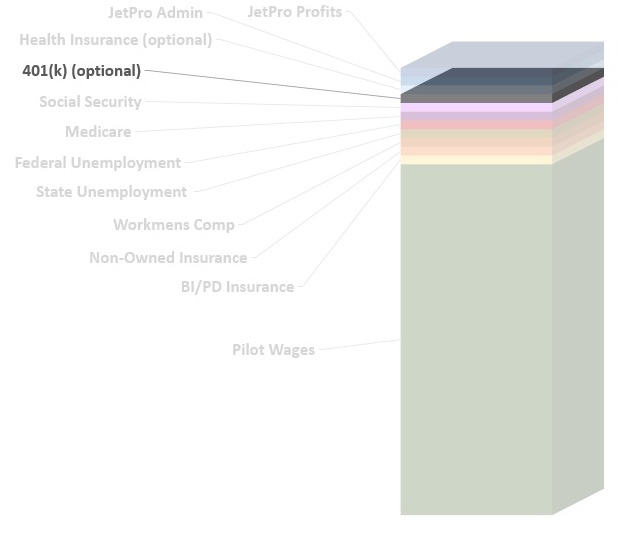

401(k)

(Optional)

JetPro Pilots offers a 401(k) retirement program to all of its employees, both full-time and part-time. This program allows employees to save their JetPro Pilots earnings for retirement on a pre-tax basis. This is an optional program based on the type of assignment by the employee. JetPro Pilots pays administrative and third-party administrator fees that are required to maintain the program.

A 3% JetPro Pilots employer match is offered to full-time employees only, which includes administrative staff as well as pilots, flight attendants, and technicians that may be assigned on a permanent retainer program, assigned to a specific client. For those employees who receive the JetPro Pilots match, this fee is absorbed by JetPro Pilots and not passed on to its clients.

winner: part-time and full-time crew & their families

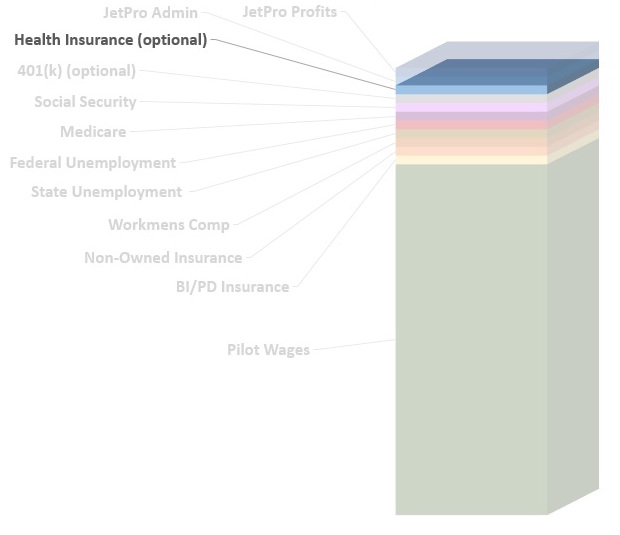

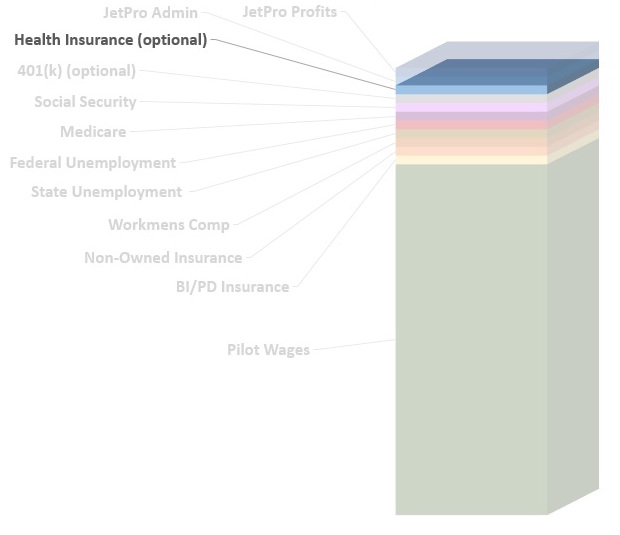

health insurance

(OPTIONAL)

In a similar fashion to the retirement program, JetPro Pilots also offers a full health insurance package to its full-time employees, including the administrative team as well as full-time aviation crew members who are on a full-time retainer assignment. JetPro Pilots has negotiated and purchased an insurance plan with solid coverage at an affordable price. For clients requesting a retainer program, the employer/employee split for the shared insurance premium can often be negotiated.

winner: full-time crew & their families

jetpro pilots administration

JetPro Pilots of course incurs costs when it pays its administrative employees. Our employees are utilized to build & maintain our internal systems, recruit new pilots, flight attendants, and techs, and monitor their records to ensure everyone stays current to protect our clients. These are administrative and HR expenses that any operation would incur in properly managing its personnel.

However, JetPro Pilots leverages its own proprietary technology customized for business aviation, working very hard to stay lean and efficient and keep costs as low as possible for our clients. Business aviation staffing is what we do, and we believe that with our scale and customized systems, we can do it as efficiently (or more efficiently) than any competitor or flight department trying to do this on their own.

winner: jetpro pilots's operations team for getting a fair wage

jetpro profits

We would be remiss if we did not acknowledge that our ownership expects to make a profit, as most businesses do. However, JetPro Pilots also believes in doing the right thing, taking good care of its clients, and growing the company organically. We are in this business for the long run, and we cherish the relationships with our crew members and clients. We work for win-win in every business transaction. Our ownership ensures that everyone else is paid and taken care of first.

winner: jetpro pilots ownership

conclusion

We have outlined the various expenses that a properly insured and professional flight department would incur anyway, even if they did not hire JetPro Pilots. JetPro Pilots maintains an efficient operation, and with the intense focus on making our business more efficient and effective, we feel strongly that we can do a better job at securing quality crew members than the average flight department. This isn’t because we’re smarter or better, but because we are specialized and focused. JetPro Pilots offers a great values and access to a very robust pilot network, all for a very competitive price.

winners: client, crew, and jetpro pilots

- Why the Markup?

- 1. Pilot Wages

- 2. BI/PD Insurance

- 3. Non-Owned Physical Damage

- 4. Workers' Compensation

- 5. State Unemployment

- 6. Federal Unemployment

- 7. Medicare (Employer Responsibility)

- 8. Social Security (Employer Responsibility)

- 9. 401(k) (optional)

- 10. Health Insurance (optional)

- 11. JetPro Pilots Administration

- 12. JetPro Pilots Profits

- Conclusion

What's included in the "markup"?

When thinking about the cost of a trip, it’s natural to multiply the pilot or flight attendant’s daily rate times the number of days then add expenses. That certainly covers the majority of the costs.

However, when trying to understand the whole picture, including staying legal and properly managing risk, we need to peel back the various layers to understand the taxes, insurance, and other personnel costs (that employers are typically required to pay) so that informed decisions can be made.

pilot wages

The pilot’s base rate is typically set as a daily rate based on the aircraft type. This rate is the pilots gross wages, and the pilot is then responsible for his or her own taxes and withholdings from this figure (the green portion of the graph). The remaining items below (which comprise the markup) are the company’s responsibilities that are typically paid in a professionally managed flight department operation.

winner: flight crew for getting a fair wage for an honest day’s work

insurance

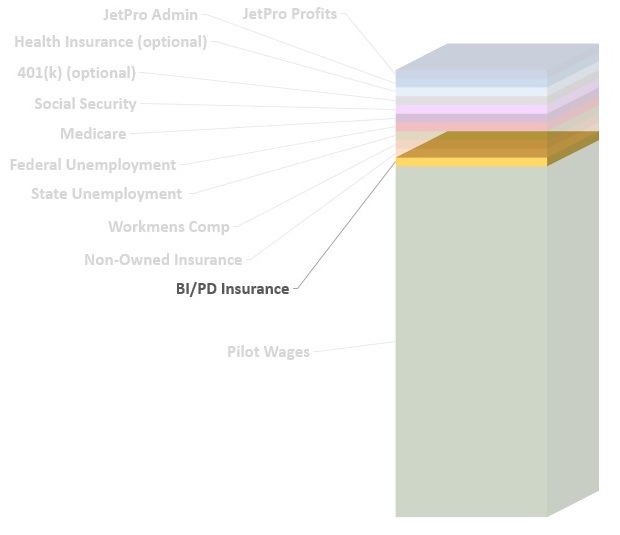

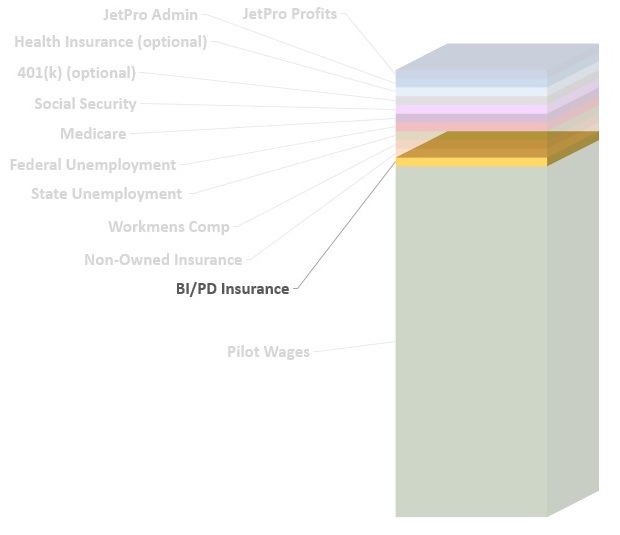

bodily injury & property damage (BI/PD)

The first two insurance items comprise the basics of the “CGL” or Commercial General Liability policy. The bodily injury & property damage covers the person (the employee) when it comes to general types of accidents. It also can cover property damage on the premises. However, a more robust insurance policy, such as the one that JetPro Pilots carries, will also include ‘Completed Operations’ coverage, which also covers accidents that happen away from the premises, since pilots and flight attendants are frequently working in locations away from their base of operation. JetPro Pilots’s CGL policy carries full BI/PD coverage.

winners: flight crews and client, as both enjoy protection and coverage that our policies offer

insurance

non-owned physical damage

A CGL policy (along with a properly structured contract) may cover the employee and the property owned by the company and client. However, it will not necessarily cover property owned by others unless the policy includes non-owned coverage, like JetPro Pilots’s policy does.

winners: flight crews, client, and other property owners who could be involved in a claim

insurance

workers' compensation

This issue touches two things: the law and proper risk management. Workers’ compensation insurance is required in many states. For those states in which workers’ compensation is required, some independent contractors who do not carry workers’ compensation may not be operating legally. It is also important to remember that even if the pilot operates independently in a state that does not require workers’ compensation insurance, this is still a risk to the flight department and the company.

An injury to an independent contractor who is not covered by workers’ compensation could cause unnecessary risk for a flight department. JetPro Pilots carries a robust workers’ compensation policy, and everyone that works for JetPro Pilots is fully covered under this policy.

winners: crew, client, and JetPro Pilots.

state unemployment

JetPro Pilots handles all of the payroll taxes for its employees. This includes state unemployment, also known as SUTA. While many of our crew members fly with us on a part-time basis, we have some that work full-time with JetPro Pilots and enjoy the protection that this insurance offers. The state unemployment is a tax-like insurance premium administered by the state governments that is required to be paid by the employer. JetPro Pilots administers and pays the mandatory state unemployment through its payroll process each pay period.

winner: crew

federal unemployment

Federal unemployment tax, also known as FUTA, works in conjunction with the state unemployment programs, is also mandatory for employers. JetPro Pilots also pays FUTA as part of its regular payroll process.

winner: crew

medicare

Both the employee and the employer are required to pay their share of Medicare tax. This is split evenly between the employer and employee, each paying half of the total tax. JetPro Pilots withholds the proper Medicare tax from each employee’s paycheck and administers the payments to the federal government through its payroll processing company. JetPro Pilots also pays the employer portion of the Medicare taxes.

winner: crew

social security

The social security tax, formally known as the ‘old-age, survivors, and disability insurance tax’ (OASDI) is administered in a similar fashion as Medicare. Both the employee and employer are required to pay their share of this tax. This is also administered and paid through JetPro Pilots’s payroll process. OASDI and Medicare are sometimes combined and referred to as FICA, or the Federal Insurance Contributions Act Tax.

winner: crew

401(k)

(Optional)

JetPro Pilots offers a 401(k) retirement program to all of its employees, both full-time and part-time. This program allows employees to save their JetPro Pilots earnings for retirement on a pre-tax basis. This is an optional program based on the type of assignment by the employee. JetPro Pilots pays administrative and third-party administrator fees that are required to maintain the program.

A 3% JetPro Pilots employer match is offered to full-time employees only, which includes administrative staff as well as pilots, flight attendants, and technicians that may be assigned on a permanent retainer program, assigned to a specific client. For those employees who receive the JetPro Pilots match, this fee is absorbed by JetPro Pilots and not passed on to its clients.

winner: part-time and full-time crew & their families

health insurance

(OPTIONAL)

In a similar fashion to the retirement program, JetPro Pilots also offers a full health insurance package to its full-time employees, including the administrative team as well as full-time aviation crew members who are on a full-time retainer assignment. JetPro Pilots has negotiated and purchased an insurance plan with solid coverage at an affordable price. For clients requesting a retainer program, the employer/employee split for the shared insurance premium can often be negotiated.

winner: full-time crew & their families

jetpro pilots administration

JetPro Pilots of course incurs costs when it pays its administrative employees. Our employees are utilized to build & maintain our internal systems, recruit new pilots, flight attendants, and techs, and monitor their records to ensure everyone stays current to protect our clients. These are administrative and HR expenses that any operation would incur in properly managing its personnel.

However, JetPro Pilots leverages its own proprietary technology customized for business aviation, working very hard to stay lean and efficient and keep costs as low as possible for our clients. Business aviation staffing is what we do, and we believe that with our scale and customized systems, we can do it as efficiently (or more efficiently) than any competitor or flight department trying to do this on their own.

winner: jetpro pilots's operations team for getting a fair wage

jetpro profits

We would be remiss if we did not acknowledge that our ownership expects to make a profit, as most businesses do. However, JetPro Pilots also believes in doing the right thing, taking good care of its clients, and growing the company organically. We are in this business for the long run, and we cherish the relationships with our crew members and clients. We work for win-win in every business transaction. Our ownership ensures that everyone else is paid and taken care of first.

winner: jetpro pilots ownership

conclusion

We have outlined the various expenses that a properly insured and professional flight department would incur anyway, even if they did not hire JetPro Pilots. JetPro Pilots maintains an efficient operation, and with the intense focus on making our business more efficient and effective, we feel strongly that we can do a better job at securing quality crew members than the average flight department. This isn’t because we’re smarter or better, but because we are specialized and focused. JetPro Pilots offers a great values and access to a very robust pilot network, all for a very competitive price.

winners: client, crew, and jetpro pilots

- Why the Markup?

- 1. Pilot Wages

- 2. BI/PD Insurance

- 3. Non-Owned Physical Damage

- 4. Workers' Compensation

- 5. State Unemployment

- 6. Federal Unemployment

- 7. Medicare (Employer Responsibility)

- 8. Social Security (Employer Responsibility)

- 9. 401(k) (optional)

- 10. Health Insurance (optional)

- 11. JetPro Pilots Administration

- 12. JetPro Pilots Profits

- Conclusion

What's included in the "markup"?

When thinking about the cost of a trip, it’s natural to multiply the pilot or flight attendant’s daily rate times the number of days then add expenses. That certainly covers the majority of the costs.

However, when trying to understand the whole picture, including staying legal and properly managing risk, we need to peel back the various layers to understand the taxes, insurance, and other personnel costs (that employers are typically required to pay) so that informed decisions can be made.

pilot wages

The pilot’s base rate is typically set as a daily rate based on the aircraft type. This rate is the pilots gross wages, and the pilot is then responsible for his or her own taxes and withholdings from this figure (the green portion of the graph). The remaining items below (which comprise the markup) are the company’s responsibilities that are typically paid in a professionally managed flight department operation.

winner: flight crew for getting a fair wage for an honest day’s work

insurance

bodily injury & property damage (BI/PD)

The first two insurance items comprise the basics of the “CGL” or Commercial General Liability policy. The bodily injury & property damage covers the person (the employee) when it comes to general types of accidents. It also can cover property damage on the premises. However, a more robust insurance policy, such as the one that JetPro Pilots carries, will also include ‘Completed Operations’ coverage, which also covers accidents that happen away from the premises, since pilots and flight attendants are frequently working in locations away from their base of operation. JetPro Pilots’s CGL policy carries full BI/PD coverage.

winners: flight crews and client, as both enjoy protection and coverage that our policies offer

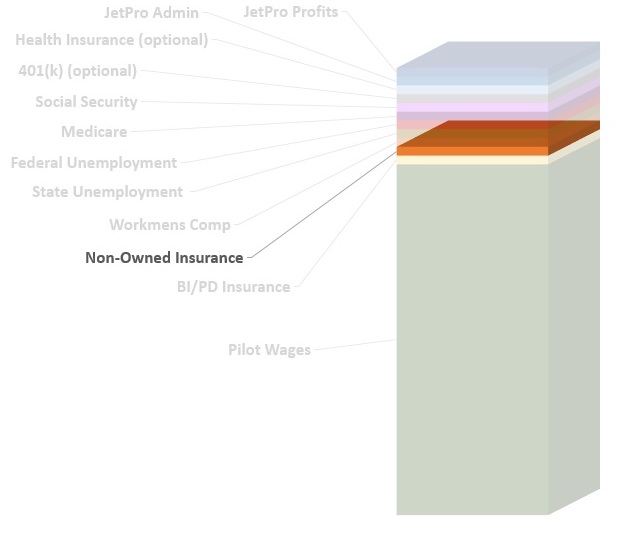

insurance

non-owned physical damage

A CGL policy (along with a properly structured contract) may cover the employee and the property owned by the company and client. However, it will not necessarily cover property owned by others unless the policy includes non-owned coverage, like JetPro Pilots’s policy does.

winners: flight crews, client, and other property owners who could be involved in a claim

insurance

workers' compensation

This issue touches two things: the law and proper risk management. Workers’ compensation insurance is required in many states. For those states in which workers’ compensation is required, some independent contractors who do not carry workers’ compensation may not be operating legally. It is also important to remember that even if the pilot operates independently in a state that does not require workers’ compensation insurance, this is still a risk to the flight department and the company.

An injury to an independent contractor who is not covered by workers’ compensation could cause unnecessary risk for a flight department. JetPro Pilots carries a robust workers’ compensation policy, and everyone that works for JetPro Pilots is fully covered under this policy.

winners: crew, client, and JetPro Pilots.

state unemployment

JetPro Pilots handles all of the payroll taxes for its employees. This includes state unemployment, also known as SUTA. While many of our crew members fly with us on a part-time basis, we have some that work full-time with JetPro Pilots and enjoy the protection that this insurance offers. The state unemployment is a tax-like insurance premium administered by the state governments that is required to be paid by the employer. JetPro Pilots administers and pays the mandatory state unemployment through its payroll process each pay period.

winner: crew

federal unemployment

Federal unemployment tax, also known as FUTA, works in conjunction with the state unemployment programs, is also mandatory for employers. JetPro Pilots also pays FUTA as part of its regular payroll process.

winner: crew

medicare

Both the employee and the employer are required to pay their share of Medicare tax. This is split evenly between the employer and employee, each paying half of the total tax. JetPro Pilots withholds the proper Medicare tax from each employee’s paycheck and administers the payments to the federal government through its payroll processing company. JetPro Pilots also pays the employer portion of the Medicare taxes.

winner: crew

social security

The social security tax, formally known as the ‘old-age, survivors, and disability insurance tax’ (OASDI) is administered in a similar fashion as Medicare. Both the employee and employer are required to pay their share of this tax. This is also administered and paid through JetPro Pilots’s payroll process. OASDI and Medicare are sometimes combined and referred to as FICA, or the Federal Insurance Contributions Act Tax.

winner: crew

401(k)

(Optional)

JetPro Pilots offers a 401(k) retirement program to all of its employees, both full-time and part-time. This program allows employees to save their JetPro Pilots earnings for retirement on a pre-tax basis. This is an optional program based on the type of assignment by the employee. JetPro Pilots pays administrative and third-party administrator fees that are required to maintain the program.

A 3% JetPro Pilots employer match is offered to full-time employees only, which includes administrative staff as well as pilots, flight attendants, and technicians that may be assigned on a permanent retainer program, assigned to a specific client. For those employees who receive the JetPro Pilots match, this fee is absorbed by JetPro Pilots and not passed on to its clients.

winner: part-time and full-time crew & their families

health insurance

(OPTIONAL)

In a similar fashion to the retirement program, JetPro Pilots also offers a full health insurance package to its full-time employees, including the administrative team as well as full-time aviation crew members who are on a full-time retainer assignment. JetPro Pilots has negotiated and purchased an insurance plan with solid coverage at an affordable price. For clients requesting a retainer program, the employer/employee split for the shared insurance premium can often be negotiated.

winner: full-time crew & their families

jetpro pilots administration

JetPro Pilots of course incurs costs when it pays its administrative employees. Our employees are utilized to build & maintain our internal systems, recruit new pilots, flight attendants, and techs, and monitor their records to ensure everyone stays current to protect our clients. These are administrative and HR expenses that any operation would incur in properly managing its personnel.

However, JetPro Pilots leverages its own proprietary technology customized for business aviation, working very hard to stay lean and efficient and keep costs as low as possible for our clients. Business aviation staffing is what we do, and we believe that with our scale and customized systems, we can do it as efficiently (or more efficiently) than any competitor or flight department trying to do this on their own.

winner: jetpro pilots's operations team for getting a fair wage

jetpro profits

We would be remiss if we did not acknowledge that our ownership expects to make a profit, as most businesses do. However, JetPro Pilots also believes in doing the right thing, taking good care of its clients, and growing the company organically. We are in this business for the long run, and we cherish the relationships with our crew members and clients. We work for win-win in every business transaction. Our ownership ensures that everyone else is paid and taken care of first.

winner: jetpro pilots ownership

conclusion

We have outlined the various expenses that a properly insured and professional flight department would incur anyway, even if they did not hire JetPro Pilots. JetPro Pilots maintains an efficient operation, and with the intense focus on making our business more efficient and effective, we feel strongly that we can do a better job at securing quality crew members than the average flight department. This isn’t because we’re smarter or better, but because we are specialized and focused. JetPro Pilots offers a great values and access to a very robust pilot network, all for a very competitive price.

winners: client, crew, and jetpro pilots

- Why the Markup?

- 1. Pilot Wages

- 2. BI/PD Insurance

- 3. Non-Owned Physical Damage

- 4. Workers' Compensation

- 5. State Unemployment

- 6. Federal Unemployment

- 7. Medicare (Employer Responsibility)

- 8. Social Security (Employer Responsibility)

- 9. 401(k) (optional)

- 10. Health Insurance (optional)

- 11. JetPro Pilots Administration

- 12. JetPro Pilots Profits

- Conclusion

What's included in the "markup"?

When thinking about the cost of a trip, it’s natural to multiply the pilot or flight attendant’s daily rate times the number of days then add expenses. That certainly covers the majority of the costs.

However, when trying to understand the whole picture, including staying legal and properly managing risk, we need to peel back the various layers to understand the taxes, insurance, and other personnel costs (that employers are typically required to pay) so that informed decisions can be made.

pilot wages

The pilot’s base rate is typically set as a daily rate based on the aircraft type. This rate is the pilots gross wages, and the pilot is then responsible for his or her own taxes and withholdings from this figure (the green portion of the graph). The remaining items below (which comprise the markup) are the company’s responsibilities that are typically paid in a professionally managed flight department operation.

winner: flight crew for getting a fair wage for an honest day’s work

insurance

bodily injury & property damage (BI/PD)

The first two insurance items comprise the basics of the “CGL” or Commercial General Liability policy. The bodily injury & property damage covers the person (the employee) when it comes to general types of accidents. It also can cover property damage on the premises. However, a more robust insurance policy, such as the one that JetPro Pilots carries, will also include ‘Completed Operations’ coverage, which also covers accidents that happen away from the premises, since pilots and flight attendants are frequently working in locations away from their base of operation. JetPro Pilots’s CGL policy carries full BI/PD coverage.

winners: flight crews and client, as both enjoy protection and coverage that our policies offer

insurance

non-owned physical damage

A CGL policy (along with a properly structured contract) may cover the employee and the property owned by the company and client. However, it will not necessarily cover property owned by others unless the policy includes non-owned coverage, like JetPro Pilots’s policy does.

winners: flight crews, client, and other property owners who could be involved in a claim

insurance

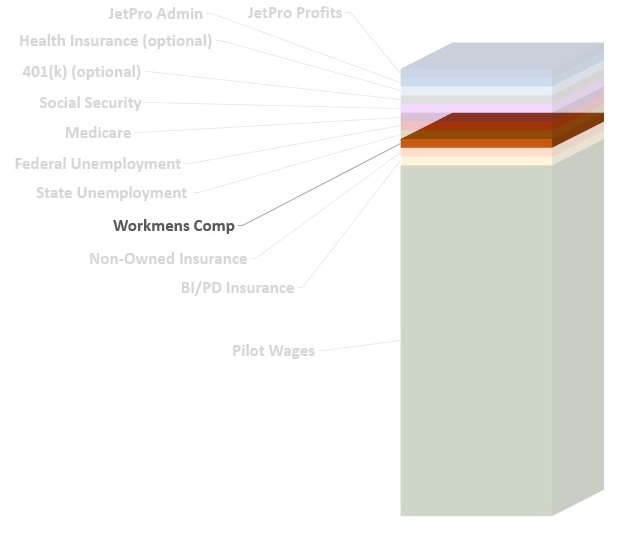

workers' compensation

This issue touches two things: the law and proper risk management. Workers’ compensation insurance is required in many states. For those states in which workers’ compensation is required, some independent contractors who do not carry workers’ compensation may not be operating legally. It is also important to remember that even if the pilot operates independently in a state that does not require workers’ compensation insurance, this is still a risk to the flight department and the company.

An injury to an independent contractor who is not covered by workers’ compensation could cause unnecessary risk for a flight department. JetPro Pilots carries a robust workers’ compensation policy, and everyone that works for JetPro Pilots is fully covered under this policy.

winners: crew, client, and JetPro Pilots.

state unemployment

JetPro Pilots handles all of the payroll taxes for its employees. This includes state unemployment, also known as SUTA. While many of our crew members fly with us on a part-time basis, we have some that work full-time with JetPro Pilots and enjoy the protection that this insurance offers. The state unemployment is a tax-like insurance premium administered by the state governments that is required to be paid by the employer. JetPro Pilots administers and pays the mandatory state unemployment through its payroll process each pay period.

winner: crew

federal unemployment

Federal unemployment tax, also known as FUTA, works in conjunction with the state unemployment programs, is also mandatory for employers. JetPro Pilots also pays FUTA as part of its regular payroll process.

winner: crew

medicare

Both the employee and the employer are required to pay their share of Medicare tax. This is split evenly between the employer and employee, each paying half of the total tax. JetPro Pilots withholds the proper Medicare tax from each employee’s paycheck and administers the payments to the federal government through its payroll processing company. JetPro Pilots also pays the employer portion of the Medicare taxes.

winner: crew

social security

The social security tax, formally known as the ‘old-age, survivors, and disability insurance tax’ (OASDI) is administered in a similar fashion as Medicare. Both the employee and employer are required to pay their share of this tax. This is also administered and paid through JetPro Pilots’s payroll process. OASDI and Medicare are sometimes combined and referred to as FICA, or the Federal Insurance Contributions Act Tax.

winner: crew

401(k)

(Optional)

JetPro Pilots offers a 401(k) retirement program to all of its employees, both full-time and part-time. This program allows employees to save their JetPro Pilots earnings for retirement on a pre-tax basis. This is an optional program based on the type of assignment by the employee. JetPro Pilots pays administrative and third-party administrator fees that are required to maintain the program.

A 3% JetPro Pilots employer match is offered to full-time employees only, which includes administrative staff as well as pilots, flight attendants, and technicians that may be assigned on a permanent retainer program, assigned to a specific client. For those employees who receive the JetPro Pilots match, this fee is absorbed by JetPro Pilots and not passed on to its clients.

winner: part-time and full-time crew & their families

health insurance

(OPTIONAL)

In a similar fashion to the retirement program, JetPro Pilots also offers a full health insurance package to its full-time employees, including the administrative team as well as full-time aviation crew members who are on a full-time retainer assignment. JetPro Pilots has negotiated and purchased an insurance plan with solid coverage at an affordable price. For clients requesting a retainer program, the employer/employee split for the shared insurance premium can often be negotiated.

winner: full-time crew & their families

jetpro pilots administration

JetPro Pilots of course incurs costs when it pays its administrative employees. Our employees are utilized to build & maintain our internal systems, recruit new pilots, flight attendants, and techs, and monitor their records to ensure everyone stays current to protect our clients. These are administrative and HR expenses that any operation would incur in properly managing its personnel.

However, JetPro Pilots leverages its own proprietary technology customized for business aviation, working very hard to stay lean and efficient and keep costs as low as possible for our clients. Business aviation staffing is what we do, and we believe that with our scale and customized systems, we can do it as efficiently (or more efficiently) than any competitor or flight department trying to do this on their own.

winner: jetpro pilots's operations team for getting a fair wage

jetpro profits

We would be remiss if we did not acknowledge that our ownership expects to make a profit, as most businesses do. However, JetPro Pilots also believes in doing the right thing, taking good care of its clients, and growing the company organically. We are in this business for the long run, and we cherish the relationships with our crew members and clients. We work for win-win in every business transaction. Our ownership ensures that everyone else is paid and taken care of first.

winner: jetpro pilots ownership

conclusion

We have outlined the various expenses that a properly insured and professional flight department would incur anyway, even if they did not hire JetPro Pilots. JetPro Pilots maintains an efficient operation, and with the intense focus on making our business more efficient and effective, we feel strongly that we can do a better job at securing quality crew members than the average flight department. This isn’t because we’re smarter or better, but because we are specialized and focused. JetPro Pilots offers a great values and access to a very robust pilot network, all for a very competitive price.

winners: client, crew, and jetpro pilots